Module 2: Feedback Loops and Causality – Lesson 3

This lesson is just one part in our series on Systems Thinking. Each lesson reads on its own, but builds on earlier lessons. An index of all previous lessons can be found at the bottom of this page.

In the vocabulary of systems thinking, stocks and flows are not just technical terms—they are the grammar of change itself. While causal loops help us see patterns of push and pull, stocks and flows reveal what truly accumulates and what slowly drains away. They remind us that time is not just a backdrop but an active participant in shaping outcomes. To grasp stocks and flows is to recognize why progress is often painstaking, why decline feels inevitable, and why meaningful leverage so often hides in the details of movement rather than in the grand declarations of intent.

From Causes to Accumulations

A stock is a quantity that endures: money in a bank account, water in a reservoir, the reputation of a brand, or even the trust between two people. Stocks are the state of the system at any moment, shaped by history. Flows, by contrast, are the rates that fill or drain those stocks: income and expenses, rainfall and evaporation, customer acquisition and churn. Flows are verbs in motion, while stocks are the nouns that persist after the action has passed.

Stocks give a system memory. They carry the imprint of yesterday’s decisions into today’s reality and tomorrow’s constraints. This persistence makes them both stabilizing and, at times, stubbornly slow to change.

The Bathtub Metaphor

Perhaps the clearest way to visualize this relationship is with a bathtub. The water level is the stock. The faucet and the drain are the flows. Turn the faucet on and the water rises; open the drain and it falls. Yet the level never shifts instantly—it changes only as water accumulates or escapes. This lag is precisely what makes stocks essential: they explain why promises and policies often take far longer to manifest than their architects expect.

Identifying Stocks and Flows

Learning to identify stocks and flows in the wild is an act of disciplined observation.

Accumulation and Action

First, ask: What builds up? Stocks are often nouns—trust, attention, backlog, inventory. Then ask: What makes it rise or fall? Flows are the verbs—earning, spending, hiring, quitting. If you can freeze a system in time and still measure it, you’ve likely found a stock. If it must be tracked across time, it is a flow.

The Bathtub Test

The bathtub test is a quick diagnostic: can you imagine this thing filling up or draining away? If yes, it is a stock. This framing makes abstractions concrete—brand loyalty feels intangible until you picture it as water slowly seeping away unless replenished.

Persistence and Memory

Stocks carry persistence. They remain long after inflows cease. Knowledge gained from study lingers, even as it slowly erodes with neglect. A reputation earned through years of service is not erased by a single stumble—though repeated outflows can drain it quickly.

Behavior Over Time

Behavior-over-time graphs sharpen this lens. Stocks reveal themselves in smooth, gradual curves; flows appear as sharp shifts or sudden spikes. By sketching trajectories, we distinguish the enduring level from the fleeting rate.

Insights from Stocks and Flows

The discipline of stocks and flows offers insights that cut across domains.

Change Takes Time

Stocks act as buffers. They absorb and release the impact of changing flows. This explains why organizations rarely pivot overnight, why ecosystems recover slowly, and why brand equity is stubbornly resistant to quick fixes.

Problems Linger

Because stocks embody memory, their problems endure. Debt hangs around even after spending is cut. A tarnished reputation outlives the scandal that sparked it. Stocks are the ghosts of flows past.

Small Shifts Compound

Minor adjustments in flows can generate massive long-term effects. A small reduction in customer churn, maintained consistently, can reshape the trajectory of an entire business. Systems reward patience and consistency far more than spectacle.

Leverage in Flows

Managers often demand, “We need more sales” or “We need more followers,” but these are stock levels. The leverage lies in flows: in increasing inflows of new customers or reducing outflows of lost ones. Stocks respond only to flows—never directly to willpower.

Capacity and Constraints

Every stock has limits. A reservoir can only hold so much water before overflowing. Human attention has a saturation point. Recognizing these boundaries prevents wasted effort and helps design strategies grounded in reality.

Real-World Examples

- Nature: A reservoir’s water level (stock) rises with rainfall (inflow) and falls through evaporation or consumption (outflow).

- Economics: A household’s bank balance (stock) grows through deposits and shrinks through expenses.

- Organizations: Employee headcount (stock) shifts with hiring (inflow) and attrition (outflow).

- Personal life: Knowledge (stock) builds with practice and study (inflow) but decays without reinforcement (outflow).

Branding and Marketing Case Study

In the realm of branding, reputation is among the most vital stocks. It is filled by inflows: positive customer experiences, glowing media coverage, authentic storytelling, and the consistent delivery of promises. It is drained by outflows: scandals, poor service, neglected communication, or inconsistent quality. Crucially, reputation cannot be conjured in a single campaign—it resists instant change. A viral advertisement may spike awareness, but it does not fill the reservoir of trust. Likewise, a single angry customer does not collapse a brand, but repeated failures can puncture the stock until it drains away.

Behavior-over-time graphs of reputation show how resilience forms: steady inflows create stability, while unchecked outflows erode even the strongest brands. For marketers, this perspective reframes strategy. Success lies not in chasing a headline but in designing flows that steadily fill and carefully guard the reservoir.

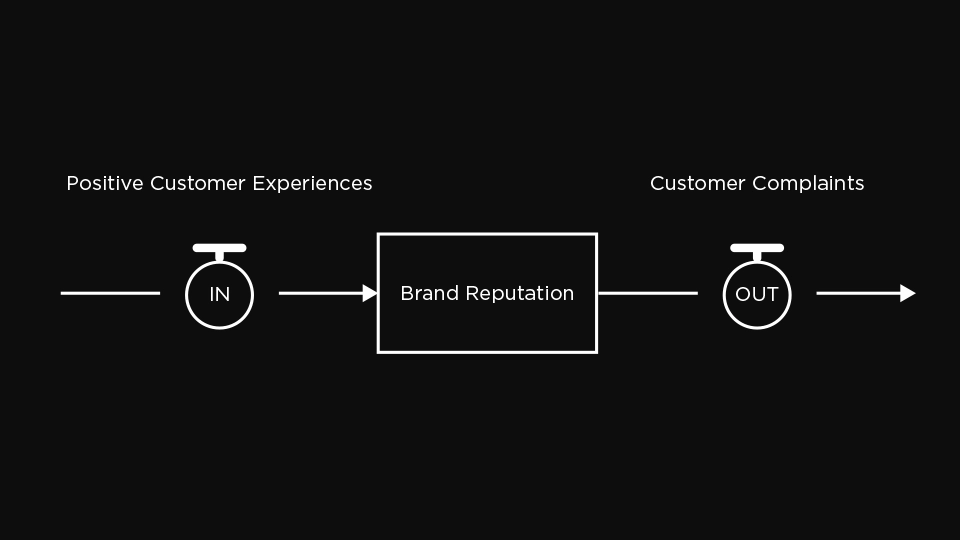

Notation

To formalize these concepts, we move from causal loop diagrams to stock-and-flow diagrams:

- Stocks are drawn as boxes, representing what accumulates.

- Flows are double-lined arrows with valve symbols, showing the rates that fill or empty the stock.

- Information links are single arrows, indicating influence without direct movement.

- Behavior-over-time graphs accompany diagrams, tracing how stocks shift as flows change.

Together, this notation helps us see not only who influences whom, but also what builds, what persists, and what leaks away.

Conclusion

Stocks and flows invite us to trade the drama of the moment for the deeper narrative of accumulation. They teach us that resilience is built drop by drop, that decline is often a slow leak rather than a sudden collapse, and that leverage lies in managing the everyday rhythms of inflow and outflow. Whether in nature, business, or culture, learning to read these patterns transforms guesswork into foresight. For branding and marketing, it reframes reputation, awareness, and loyalty as reservoirs—precious stores that must be filled carefully and defended wisely. And in systems thinking more broadly, it grounds us in the truth that while causes may be loud, it is accumulations that shape our future.

Course Index

- Module 0: Introduction to Systems Thinking

- Module 1: Components of Systems

- Lesson 1.1 — Elements, interconnections, and purpose

- Lesson 1.2 – Open vs. closed systems

- Lesson 1.3 — Boundaries and Perspectives

- Module 2: Feedback Loops and Causality

- Lesson 2.1 — Reinforcing and balancing loops

- Lesson 2.2 — Delays and non-linearity

- Lesson 2.3 — Stocks and flows